Application open for Visa’s Everywhere Initiative (VEI) Programme

Visa has announced its Everywhere Initiative (VEI) program, which is a global open innovation program that will allow fintech and payment startups to showcase their innovative products and solutions.

The overall prize money is $100,000, with second and third place winners receiving $20,000 and $10,000, respectively. One winner from each region will be chosen to compete in the global finals, which will be held in November in Qatar. The winner of the Central and Eastern Europe, the Middle East, and Africa (CEMEA) region receives $25,000 in prize money.

Other categories include Audience Favorite and Visa Direct, with winners receiving $10,000 each.

Kemi Okusanya, Vice President, Visa West Africa, commented on the announcement, saying that Fintechs have enabled timely and easier access to money.

Hence, the company’s resolve to continue to support innovation by finding and funding early players:

“Fintechs and other payments innovators are transforming the way consumers and businesses make payments, making it easier for more people to access the money they need when they need it – and the pandemic has seen this become more critical than ever”Kemi Okusanya, Vice President, Visa West Africa

Innovative fintech startups from Central and Eastern Europe, the Middle East, and Africa are encouraged to apply for exposure and access to Visa’s network, as well as a total prize pool of $45,000 USD. The VEI finals will bring together finalists from around the world who are driving economic growth.

They will get first-hand exposure to key fintech stakeholders from the banking, merchant, venture capital, and government sectors.

Startups that are eligible

The VEI program is open to innovative and ambitious entrepreneurs who are uplifting communities by addressing payment and commerce challenges that businesses of all sizes and sectors face.

Enablers of digital services and digital issuers

- Blockchain and cryptocurrency

- Crowdfunding

- Banking-as-a-Service

- BIN sponsors

- Issuer/processors

- Program managers

Digital issuance

- Blockchain and cryptocurrency

- Alternative lending

- Personal financial management

- Money transfer and remittance

- Digital banking (aka neo banks)

- Digital wallets, peer-to-peer (P2P) and transfers

- Employee benefits

- Payables

- Corporate cards (aka expense management)

Value-add for merchants and/or consumers in the finance space

- Data and analytics

- ID, authentication and security

- InsurTech

- Loyalty

- Merchant services and tools

- Process and payment infrastructure

- Retail technology

- Other

ALSO READ Meet the Startups Pitching at Seedstars Africa Regional Summit in Mozambique

Small- and medium-sized businesses

- Money movement (disbursements, Intra-account, P2P vendor and payments)

- Acceptance (e-commerce and mobile acceptance)

- Risk management (chargebacks, etc.)

- Brand management (Community building, etc.)

- Other

How to apply

Eligible startups can apply here now, as applications are currently open. Egyptian startups have until March 20, 2022, to apply, while startups in Central and Eastern Europe, the Middle East, and Africa (CEMEA) have until April 4, 2022.

About the programme

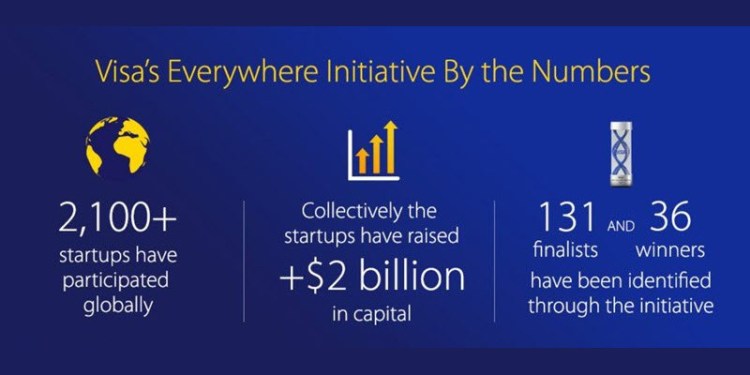

The VEI network currently includes 8,500 startups from around the world and is growing year after year. Since its inception in 2015, the program has assisted startups from over 100 countries in raising more than $2.5 billion in funding, addressing one of the most significant challenges confronting early-stage entrepreneurs.

Every year, the scope of VEI is broadened in order to engage with unique startups and solve unique problems in the payments world.

This year’s program has expanded to include startups that are using cryptocurrency and Visa Direct, a payment solution that can help businesses move money to billions of endpoints worldwide via card and account rails, in innovative ways.