Equinix To Capitalise On Fast-Growing African Data Centre Market With MainOne Buy

US digital infrastructure company Equinix has acquired Nigerian data centre company MainOne for USD320mn. MainOne operates in West Africa, with points of presence in Nigeria, Ghana and Cote d’Ivoire – marking Equinix’s first foray into the continent. The acquisition is expected to close in Q122.

Equinix’s deal with MainOne is the latest in a series of major acquisitions undertaken by the company – in August 2020 it entered the Indian market for the first time, acquiring GPX India for USD161mn and in October 2020 it purchased 13 data centres from Bell Canada for USD780mn, solidifying its leading position as a digital infrastructure provider in the country.

The acquisition of MainOne is an astute one, enabling Equinix to tap the African data centre market with a point of presence in Nigeria – the region’s second-largest cloud computing market, behind South Africa. As a result, Equinix is making its entry onto the continent at a highly strategic location and will also gain MainOne’s tier-three data centre in Lagos, West Africa’s largest cloud computing facility.

Nigeria has seen a flurry of investment activity from data centre operators of late: Digital Realty, a primary rival of Equinix’s, entered the market via acquisition of Medallion Data Centres in October 2021 and in November 2021, Africa Data Centres opened a new 10MW facility in Lagos. Consequently, it is clear that there is a growing level of interest in Nigeria’s digital transformation and we suspect deal flow to remain over the medium-term given its conducive environment for uptake of technology.

Pandemic-Driven Demand For Data

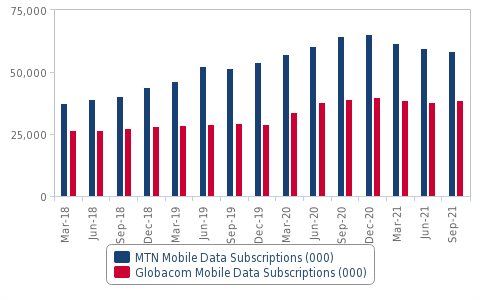

Nigeria - MTN & Globacom Mobile Data Subscriptions, '000 (2018-2021)

Source: MTN, Globacom, Fitch Solutions

Nigeria is by far Sub-Saharan Africa's (SSA) largest country in terms of population size and thus Equinix will be well-placed to capitalise on the surging level in the demand for data that has occurred across the continent. Nigeria’s primary telecoms operators, MTN and Globacom, have experienced a significant level of growth in terms of mobile data subscribers since the onset of the Covid-19 pandemic and a complementary level of digital infrastructure will be required to support this, implying a huge level of opportunity for companies like Equinix.

Data consumption in Ghana has followed a similar trend and as a result the country has seen a sustained level of investment, improving its access to international bandwidth, MainOne being one of the critical operators facilitating this. As a result, we place Ghana among the region’s leading cloud computing locations in our forecasts out to 2024.

Through the acquisition, Equinix will inherit MainOne’s 7,000km-long submarine cable that has landing stations in Nigeria, Ghana and Portugal, as well as branch connections serving Morocco, the Canary Islands, Senegal and Cote d’Ivoire. Also included is MainOne’s 1,200km terrestrial fibre network in Nigeria, another complementary addition to Equinix’s portfolio. Obtaining a fibre network is in line with our view that it is no longer enough for digital infrastructure owner-operators to specialise in just one – or even two – layers of the digital stack. Therefore, it is likely we will see Equinix and its rivals attempt to establish a greater presence in alternative layers of the digital infrastructure space.

Adding several African markets to its portfolio in one move reinforces Equinix’s position as one of the largest data centre companies in the world. As of December 2021, Equinix owns more than 230 data centres across 27 countries worldwide, with the MainOne transaction to immediately enhance this number. Equinix will also receive 570,000 sq ft of land which it will use to boost its African portfolio further.

African Data Centre Market Primed For Growth

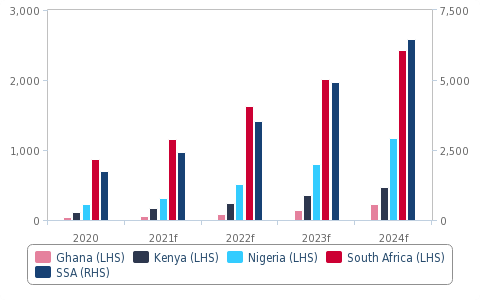

SSA Cloud Computing Market Size, USDmn (2020-2024)

f= Fitch Solutions forecast. Source: Fitch Solutions

Looking forward, we expect Equinix will actively pursue further acquisitions on the African continent in order to bolster its position and capitalise on the flourishing cloud computing market there. Our cloud computing market forecasts place SSA as the fastest-growing region worldwide, developing at a CAGR of 38.7% between 2021 and 2024.