Flexible Payments And Affordability Make BNPL Attractive In Kenya

Relatively Low Incomes Make Flexible Payment Terms Attractive

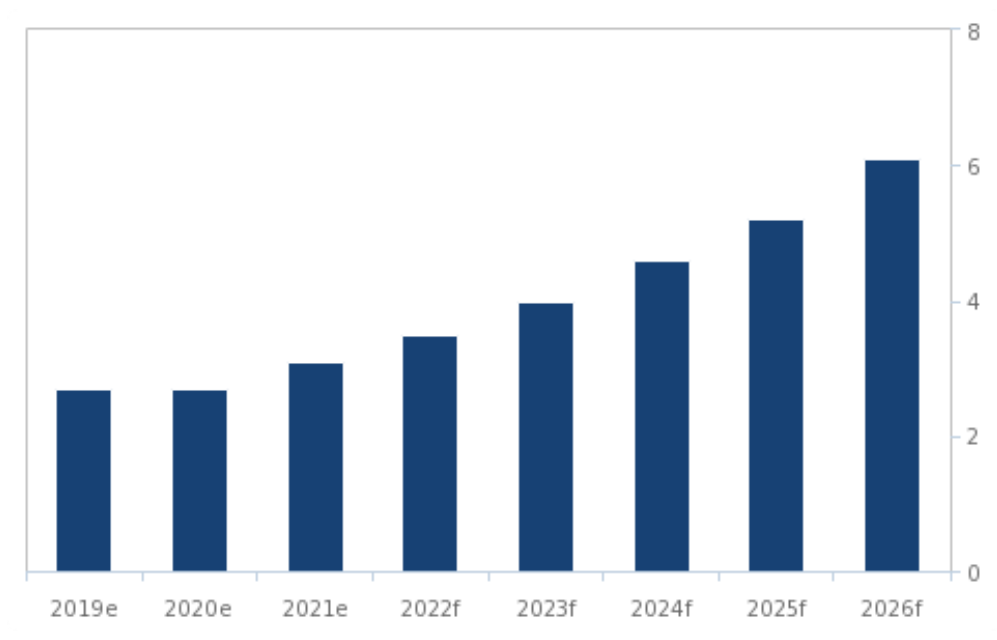

In 2022, we forecast disposable income per household to average KES312,123 (USD2,795), which will increase to KES287,695 (USD2,623) by 2026. While disposable incomes will post good growth over the medium term (2022-2026) as economic activity increases, growth will be coming from a low base and nominal levels will be low. Furthermore, we note that while Kenya has a growing number of middle-class households with disposable income of USD10,000-plus, it will remain relatively small with only 3.5% of households in the country falling into this income bracket in 2022, increasing to 6.1% in 2026. As a result, we believe that these dynamics in the Kenyan market make Buy-Now-Pay-Later (BNPL) an attractive way for a large number of consumers in the country to purchase consumer goods, such as clothing and footwear, electronics and household goods through flexible payment terms at a low interest rate.

Middle Class Will Remain Relatively Small

Kenya - Households Disposable Income USD10,000+, % of total households (2019-2026)

e/f = Fitch Solutions estimate/forecast. Source: National Statistics, Fitch Solutions

BNPL Platforms Will Benefit From Increasing E-Commerce Adoption

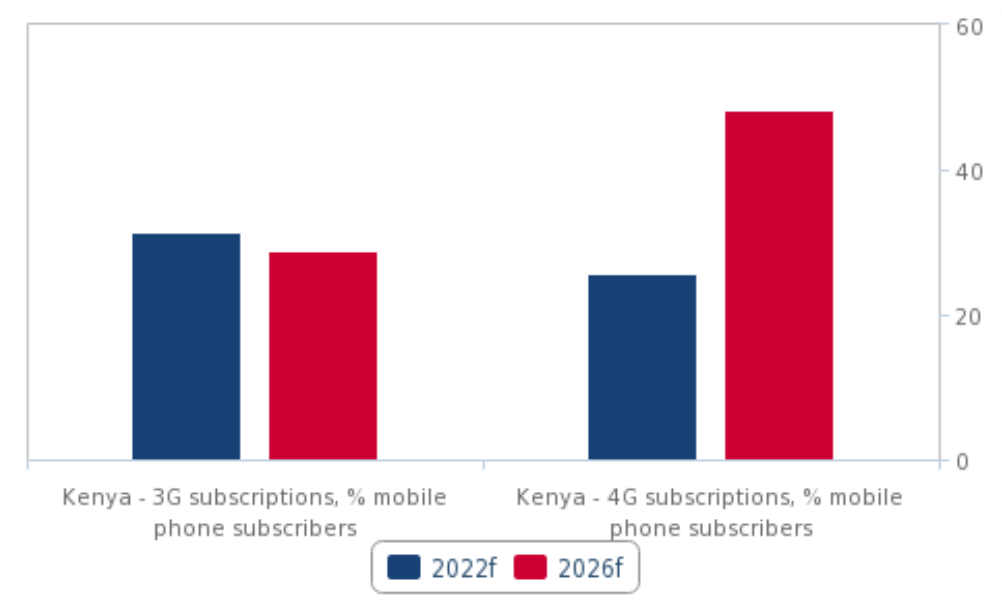

The Covid-19 pandemic has accelerated the adoption of e-Commerce in Kenya and this will aid the growth and adoption of BNPL platforms over the coming years. BNPL players typically enter into partnerships with e-Commerce platforms in order to provide consumers with an alternative payment method at the checkout stage. Kenya has a large young and tech savvy consumer base with young adults (20-39-year olds) making up 32.0% (18.0mn people) of the population in 2022. Looking ahead, we forecast this demographic group to make up 32.4% (19.9mn people) of Kenya’s population in 2026. The majority of consumers in Kenya make online purchases through a mobile device. Our Telecoms, Media and Technology team forecast Kenya’s mobile penetration rate at 120.5 per 100 people in 2022 and it will remain high over the medium term, at 120.2 per 100 people in 2026. Furthermore, the proportion of Kenyan consumers with 3G and 4G subscriptions is 31.5% and 25.8% respectively in 2022. While the proportion of 3G subscriptions will decrease to 29.0% in 2026, the proportion of subscriptions will increase to 48.3% in 2026.

Mobile Internet Penetration Will Remain Strong

Kenya - 3G & 4G, % Mobile Phone Subscribers

f = Fitch Solutions forecast. Source: Operator results, Fitch Solutions

BNPL Is Attractive For Investors

BNPL platforms have been actively investing in the Kenyan market in recent years and leveraging technology such as artificial intelligence to ensure a fast turnaround time for consumer credit applications. This has resulted in strong growth in the adoption of BNPL services by both consumers and retailers, particularly as access to credit remains a challenge for a large number of consumers in Kenya. The BNPL platforms that operate in Kenya include FlexPay Technologies and Lipa Later. In January 2022, Lipa Later, announced that it raised KES1.36mn (USD12mn) from a pre-Series A funding round. The company stated that the capital will enable further invest in Kenya and to enter other African markets, particularly Tanzania, Ghana and Nigeria.

Kenya - Selected BNPL Platforms