Mobile financial services can increase impacts of microfinance organizations—but the story is more complicated than we think

In an attempt to deepen financial inclusion, microfinance organizations are introducing digital solutions to serve low-income households and small- and medium-sized enterprises. Mobile financial services and fintech solutions are particularly promising in Africa where financial inclusion is only 43 percent, whereas mobile phone penetration is almost 90 percent. Such solutions show promise: In Kenya, for example, mobile financial services—specifically mobile money—contributed to increasing financial inclusion from 26.7 percent to 82.9 percent between 2006 and 2019.

Microfinance organizations have two goals: One is to increase financial inclusion, the other to be financially profitable—or at least financially sustainable. Balancing those goals is not easy, as leadership must choose between prioritizing social impact versus financial performance, and must consider changes that come with time, investments, environmental fluctuations, innovations, and the like. Thus, as is common when pursuing dual, often conflicting aims, optimizing both is hard.

Still, the rewards are worth it, and innovations are making this goal more achievable every day. Indeed, mobile money, fintech services, and online banking have the potential to transform the microfinance industry in Africa, given their enabling capabilities to increase both financial performance and social impact.

BENEFITS AND COSTS ASSOCIATED WITH MOBILE FINANCIAL SERVICES IMPLEMENTATION

A recent research project at Oxford University shows that mobile financial services bring benefits to organizations implementing such tools. In fact, microfinance organizations see benefits most prominently in the organization’s capabilities to: (1) serve more clients; (2) more successfully meet client demands; and (3) increase their financial strength.

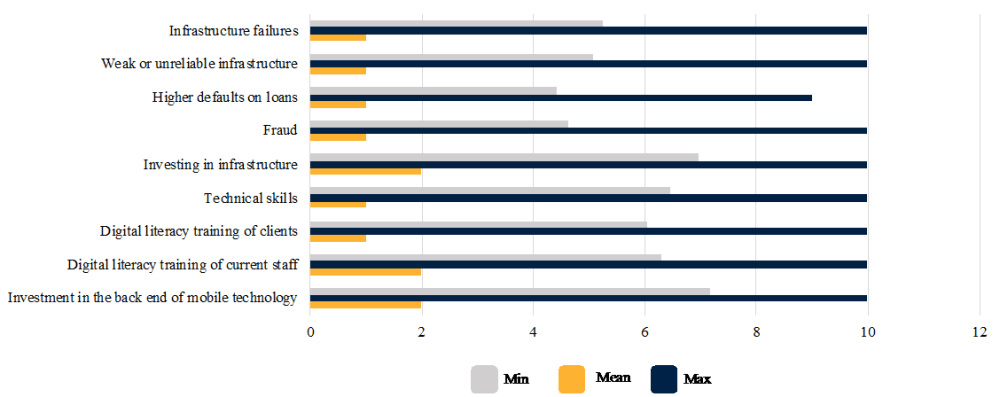

At the same time, the research further reveals that, while the benefits from mobile financial services are many, microfinance organizations contemplating investing in various fintech solutions must consider potentially high costs. The most daunting expenses include: (1) investment in the back end of mobile technology; (2) digital literacy training of current staff; and (3) digital literacy training of clients (Figure 1).

Figure 1. Costs associated with implementing mobile financial services

Source: Varendh, Cecilia. (2021). ”Mobile-mission: Technology’s impact on social enterprises logics prioritisations.” Academy of Management Proceedings. 2021.

MOBILE FINANCIAL SERVICE UPTAKE BY MICROFINANCE ORGANIZATIONS IN SUB-SAHARAN AFRICA

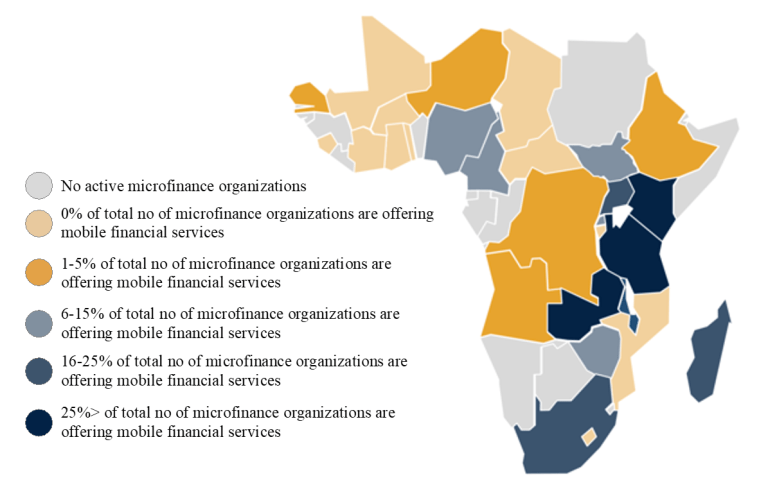

The Oxford research also found that microfinance organizations’ investment in mobile financial services has the deepest penetration in eastern and southern Africa, especially in Kenya, Zambia, and Tanzania, followed by Uganda and South Africa (Figure 2).

Figure 2. Mobile financial services adoption by microfinance organizations

Source: Varendh, Cecilia. (2021). ”Mobile-mission: Technology’s impact on social enterprises logics prioritisations.” Academy of Management Proceedings. 2021.

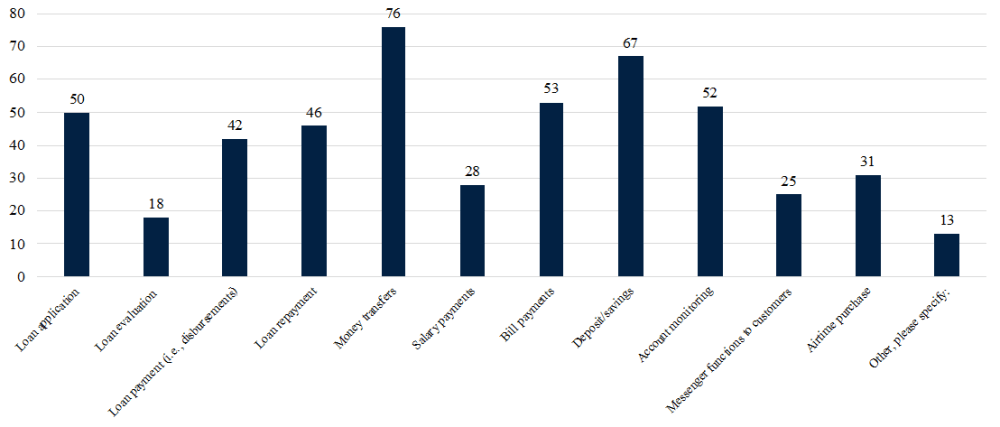

Beyond geography, the type of mobile financial services and fintech solutions implemented by microfinance organizations differs, as 83 percent of the surveyed microfinance organizations offer mobile money transfers between accounts, 74 percent offer saving and deposit opportunities, and 55 percent offer their clients mobile loan application (Figure 3).

Figure 3. Type of mobile financial services offered

Source: Varendh, Cecilia. (2021). ”Mobile-mission: Technology’s impact on social enterprises logics prioritisations.” Academy of Management Proceedings. 2021.

PARTNERSHIPS ARE CENTRAL FOR SUCCESSFUL MICROFINANCE PROJECTS USING MOBILE FINANCIAL SERVICES AND FINTECH

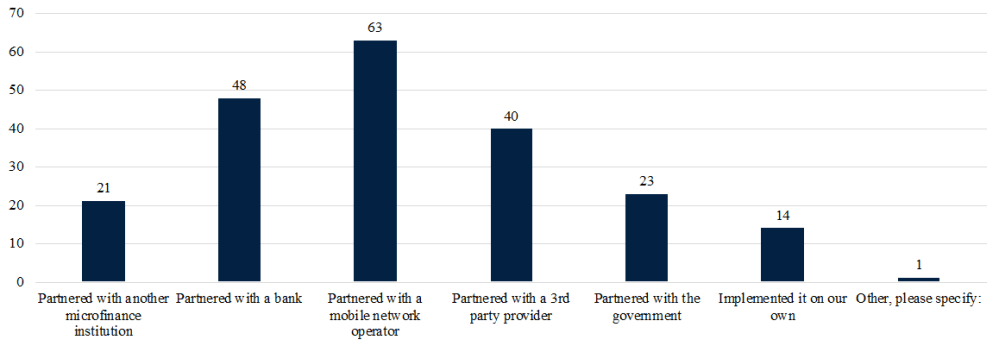

The study further shows that the majority of organizations investing in mobile financial services partner with other stakeholders, institutions, or startups. In fact, 69 percent of the surveyed microfinance organizations partner with mobile network operators; 53 percent partner with a bank; and 43 percent partner with third-party agencies, predominately fintechs (Figure 4).

Figure 4. Microfinance organizations’ various approaches when implementing mobile financial services

Source: Varendh, Cecilia. (2021). ”Mobile-mission: Technology’s impact on social enterprises logics prioritisations.” Academy of Management Proceedings. 2021.

WHAT IS THE REAL IMPACT OF MOBILE FINANCIAL SERVICES FOR MICROFINANCE ORGANIZATIONS?

The Oxford research modeled (using regression techniques, controlling for country and company specifical heterogeneity as well as for unobserved heterogeneity between years) how mobile financial services investment impacts microfinance organizations’ two goals discussed above: depth of social outreach and profitability.

Overall, the models show that mobile financial services investment decreases microfinance organizations’ social outreach intensity (proxied as microfinance organizations’ average loan size per borrower) by 41.7 percent. The models further illustrate that the decrease in social outreach intensity is different between microfinance organizations depending on their legal status as for- versus not-for-profit. More specifically, the research finds that not-for-profit organizations decrease their social outreach intensity (again, proxied as an organization’s average loan size per borrower) by 36 percent after implementing mobile financial services. Furthermore, not-for-profit organizations experience weaker financial performance (i.e., profit) associated with mobile technology investment—with an average financial loss of 3 percent. On the other hand, for-profit microfinance organizations decrease their social outreach intensity by 44 percent, while increasing their average financial performance by 20.4 percent.

POLICY RECOMMENDATIONS

The insights of this research should not be taken lightly: In short, it finds that it is far more complex and multifaceted for microfinance organizations to use mobile financial services and fintech solutions to increase their social outreach and financial strength than proposed by global think tanks and other consultancies.

These findings, however, do not necessarily negate those institutions’ conclusions: Mobile technology does have the technical capability to aid microfinance organizations to increase financial inclusion. However, the complications faced by organizations in Africa when implementing mobile technology or fintech solutions are many. Such complications and difficulties include a need for substantial capital investments, lack of trust from low-income clients to use mobile technology for financial means, the necessity for microfinance organizations to invest in financial and digital literacy programs, and low Wi-Fi penetration in remote areas. Policymakers, fintech, and edtech entrepreneurs should take those implications into account to aid microfinance organizations to utilize mobile technology to increase both their financial strength and social outreach intensity.

The Oxford study further highlights the importance of policy changes: To aid microfinance organizations to successfully take full advantage of mobile financial services implementation, policies should promote digital financial training; facilitate and/or fund fintech solutions that are easily and financially accessible for microfinance organizations; strengthen and implement fraud prevention mechanisms and laws; and implement digital banking identification numbers.

By: Cecilia Värendh Månsson Founder and CEO

TalentUp Africa Research Fellow - SAID Business School