Mobile money dominates fintech investment in Africa

Financial technology, colloquially referred to as “fintech,” is accelerating financial inclusion in sub-Saharan Africa—a region that traditionally suffers from limited access to formal financial services, such as credit, insurance, and banking. While in recent years the opportunities made possible by this technology have opened doors for many in the region—especially low-income households—users of fintech are utilizing the tool in more and more sophisticated ways, as seen in a recent paper by Financial Technology Partners, a boutique investment banking firm, which reveals promising investment trends in the African FinTech industry.

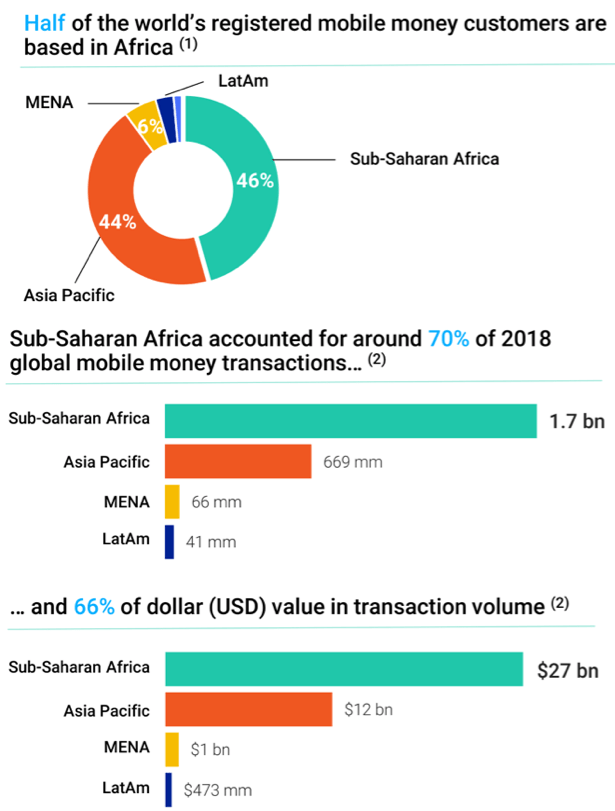

The population of Africa will likely continue to utilize the region’s rising cellular and internet penetration and adopt emerging digital payment, banking, insurance, and lending services. As such, the authors speculate that Africa’s demand for financial services—especially as the population remains largely un- or under-banked while also being the world’s second-fastest-growing payments and banking market—will soon bypass traditional banking systems. Importantly, the continent is already the largest adopter of mobile money transfer systems (Figure 1), comprising nearly half of the globe’s registered mobile money customers, approximately 70 percent of global mobile money transactions, and two-thirds of the transaction volume by value. Despite this success, challenges to the use of the tool in new and innovate ways persist: Indeed, the authors contend that lingering low penetration of cellular and internet networks, particularly in rural Africa, suggests mobile money services still have significant growth potential in the region.

Figure 1. Composition of sub-Saharan Africa’s mobile money utilization

Source: Financial Technology Partners, “FinTech in Africa: Leapfrogging Legacy Straight to Mobile,” 2019.

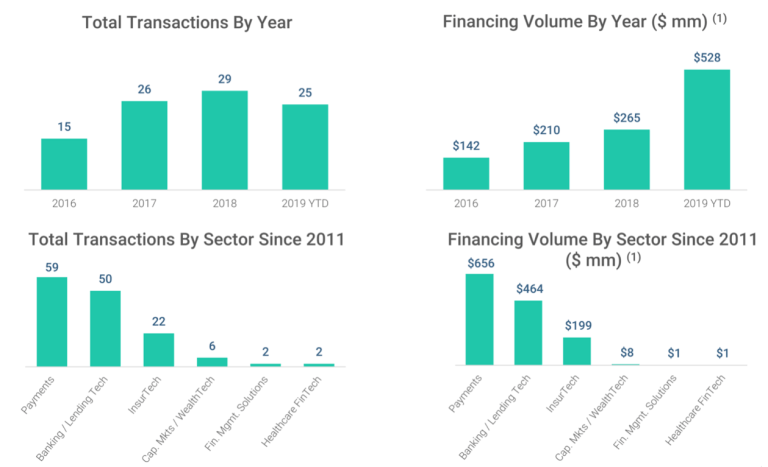

The steep influx of capital raised by African fintech startups provides evidence of the current and future prominence of digital financial services across the continent (Figure 2). This digital industry has experienced consistent growth since 2016 in terms of both the number of transactions and financing volume.

Figure 2. African fintech investment flows over time

Source: Source: Financial Technology Partners, “FinTech in Africa: Leapfrogging Legacy Straight to Mobile,” 2019.

In terms of types of services, fintech firms specializing in digital payments dominate sub-Saharan Africa’s fintech investment landscape by both financing and transactional metrics. Meanwhile, fintech dedicated to digital banking and lending services follows closely behind in the number of investment transactions, but receives 40 percent less financing than digital payment services.

Notably, many of the region’s local fintech startups are based in sub-Saharan Africa’s tech hubs: Nigeria, Kenya, and South Africa. However, due to fintech’s geographic concentration in Africa and its limited, but expanding, access to financing and business scaling, the authors indicate that African fintech firms predominantly operate within their country of origin or regionally, and, consequently, Africa’s digital payment systems are highly fragmented.

The proliferation of mobile financial services, according to the authors, indicates fintech’s potential to revolutionize financial inclusion in sub-Saharan Africa. For investors, write the authors, demographic trends in the region, such as a sizable fast-growing population, the expanding middle class, and the significantly underdeveloped financial services industry, signal the region’s burgeoning demand for digital financial technologies. For African consumers, fintech innovations provide access to vital financial services and so the authors recommend improving the penetration of telecommunications infrastructure, which will continue to enable equitable access to finance for all Africans.

For more on taxing such financial transactions, see the paper, “Taxing mobile phone transactions in Africa: Lessons from Kenya.” For more on investment trends in Africa, read “Figures of the week: Venture capital trends in Africa” and AGI Senior Fellow Landry Signé’s book “Unlocking Africa’s Business Potential.”