Negative Outlook On Zambia Railway Construction Opportunities

Zambia has two core railways: First, the Main Line, operated by state-owned Zambia Railways (ZRL), connects Victoria Falls with Kitwe in Zambia's Copperbelt, via Lusaka. In Victoria Falls, on the border with Zimbabwe, the line connects with Zimbabwe’s railway towards Beitbridge, on the South African-Zimbabwean border and ultimately connects Zambia and South Africa’s industrial hub Gauteng, as well as its sea ports in Durban and Richards Bay. Second, the Tazara line, owned by the governments of Zambia and Tanzania and operated by the Tanzania-Zambia Railway Authority (TAZARA), links Zambia with Dar es Salaam port in Tanzania, beginning in Kapiri Mposhi, where it connects with the ZRL Main Line.

The opening of the Tazara railway to private operators has increased freight volumes on the railway and poses an upside risk for investment in the railway's maintenance. The railway, which connects the Zambian rail network with Dar es Salaam, is owned by the governments of Tanzania and Zambia and operated and maintained by the Tanzania-Zambia Railway Authority (TAZARA). In 2018, TAZARA opened access to the line to private operator Calabash Freight Ltd. During the 2018/19 financial year, Calabash's operations contributed more than half of the freight volumes transported on the line in 2018/19, growing overall freight volumes transported on the railway by more than 60% compared with the previous financial year. Despite the global drop in global demand for copper—Zambia’s main mineral export—, Calabash and TAZARA respectively transported 197 thousand and 182 thousand tonnes of freight in 2019/20, a 4.5% uptick versus total freight volumes transported on the line in 2018/19, followed by reported 26.6% y-o-y growth in 2020/21. Against the backdrop of this capacity utilitisation improvement, we expect that TAZARA will open access to the railway to more private operators, growing both overall utilisation of the line and its own revenues through open-access fees. We expect this to improve both the case and capacity for investment in the railway line's maintenance. According to TAZARA, necessary works on the line would require more than USD0.5bn in financing. Demand for freight transport on the Tazara railway will remain robust, as we forecast Zambian copper mine production to exceed 1mn tonnes in 2029, up from 880 thousand tonnes forecast for 2022. Ongoing and planned improvements of port infrastructure in Dar es Salaam will support the transport route's competitiveness vis-a-vis alternative export corridors via South Africa.

Muted Outlook For Rail Infrastructure Investment In Zambia

Zambia - Existing and Planned Core Railway Infrastructure

Source: Fitch Solutions

We maintain a muted medium-term outlook on large-scale investments in both the rehabilitation of Zambia's Main Line infrastructure and the construction of new rail connections, as the government's efforts to consolidate the household will likely limit upside risks for rail rehabilitation spending posed by improved investor sentiment following Zambia's 2021 regime change and business-friendly reforms. To the West, the planned North-Western rail project ought to connect Chingola, located on the Copperbelt segment of Zambia’s Main Line, with Angola’s Benguela railway at Luacano. The Benguela railway runs from Angola’s Lobito port to Tenke in the DR Congo’s Katanga province and serves to export Congolese minerals via Lobito.

The North-Western railway would enable Zambia to transport its own mineral exports to Lobito port without relying on the DRC’s railway infrastructure, which would also require constructing a railway connection between Kitwe in Zambia and Tenke in the DRC. Further, the North-Western railway would run by the mineral deposits in Zambia’s North-Western province, facilitating their exports via Lobito. While it was reported in 2021 that the project has attracted USD1.0bn of funding, this remains to be corroborated and we maintain a negative outlook on the project. In addition to the lack of progress on the rail project itself, the Angolan government announced in 2021 that it was seeking a new concessionaire for the Benguela railway. We expect that the resulting uncertainty around the future operations of the railway will further mute investor interest in the construction of a Zambian connection.

To the east, the Chipita-Mchinji line runs a short distance from Chipata across the Zambian-Malawian border. At Mchinji, it connects with the Sena line, which links with the Nacala railway towards Mozambique’s Nacala port and the Beira railway towards Mozambique’s Beira port. A railway line is supposed to link the Chipita-Mchinji line with the Tazara line at Serenje. The project was originally supposed to be built by China Civil Engineering Construction Corporation, with the Export-Import Bank of China providing financing towards the USD2.03bn project costs, but the government’s spending constraints support a recent report that the government aims to implement the project through a public-private partnership and with private sector financing instead. A modest track record for such projects in the region and increased security risks near Nacala port underpin our negative outlook for the implementation of this project. We thus do not expect the connection to be constructed any time soon.

While the government’s move towards more business-friendly reforms and an expected near-term agreement with the IMF will improve Zambia’s overall risk profile, the country’s construction industry will retain significant risks, limiting the overall access to rail infrastructure development opportunities for less risk-tolerant companies in particular. Project risks that weigh on the attractiveness of Zambia’s rail construction sector include supply chain risks, uncompetitive labour costs, security risks and high levels of corruption. Supply chain risks in Zambia are underlined by the country's weak transport network, high reliance on congested roads, limited port access through regional peers, and unreliable electricity supply. Labour costs in Zambia are some of the highest in the region due to the country's high minimum wage, a poor ratio of valued added per worker to minimum wage and the ever-present threat of workers going on strike, which has caused costly work stoppages for businesses in the past. High levels of perceived corruption, under-resourced legal institutions, and weak enforcement capabilities, elevate the cost of operating in Zambia.

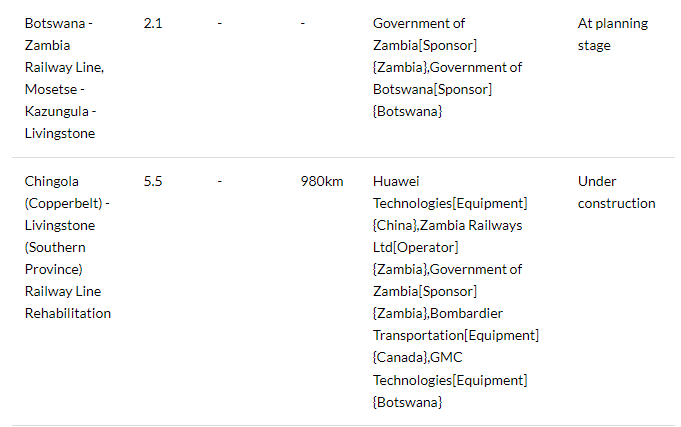

Zambia - Major Rail Infrastructure Projects

Note: Top five projects by value. Project Risk Metric scores out of 10; higher score = lower risk. na = not available. Source: Fitch Solutions Infrastructure Key Projects Data